The 9 best DeFi DApps to try in 2024

Blockchain technology has revolutionized the way we interact with digital assets and financial services, offering greater transparency and security in a decentralized manner. One of the most exciting developments in the blockchain space is the emergence of Decentralized Finance or DeFi.

DeFi provides a financial ecosystem that operates on blockchain technology, allowing users to access financial services without intermediaries such as banks or other financial institutions. This article will explore the 9 best DeFi DApps in 2024. These DApps offer users a range of financial services in a secure and decentralized manner, paving the way for a more inclusive and transparent financial future.

Yearn

Yearn is a DeFi DApp that offers a range of yield farming strategies to maximize returns for users' cryptocurrency holdings. It is built on the Ethereum blockchain and operates as a decentralized autonomous organization (DAO), with decisions made by community members who hold the YFI governance token.

One main reason Yearn is on this list is its automated yield farming, which involves lending and borrowing cryptocurrencies to earn interest and rewards. In addition, yearn's smart contracts automatically allocate user funds to the most profitable yield farming strategies, providing users with the highest possible returns on their investments.

Yearn's unique features, such as its automation and community governance, have made it one of the top DeFi DApps in 2024. In addition, its user-friendly interface, security, and reliability make it an attractive option for users looking to maximize their cryptocurrency holdings in a decentralized and efficient manner.

Alchemix

Alchemix is a DeFi DApp that offers a unique way to access liquidity without having to sell cryptocurrency holdings. It is built on the Ethereum blockchain and operates as a decentralized autonomous organization (DAO), with decisions made by community members who hold the ALCX governance token.

Alchemix's platform allows users to deposit cryptocurrency, which is then used as collateral to mint a synthetic stablecoin called alUSD. This stablecoin can be used to borrow against, with the amount borrowed increasing over time as the deposited cryptocurrency's value increases. The borrowed funds can be used for any purpose, including purchasing additional cryptocurrency or making investments.

Alchemix makes this list mainly due to its ability to provide users with liquidity without having to sell their cryptocurrency holdings, allowing them to benefit from potential price appreciation while still accessing funds. Alchemix also offers low transaction fees and fast transaction times, making it an attractive option for users.

UniSwap

UniSwap is a decentralized exchange (DEX) DeFi DApp built on the Ethereum blockchain. It allows users to trade cryptos without the need for intermediaries, providing greater control and security over their transactions.

UniSwap provides users with access to a wide range of cryptocurrencies. It also offers a high degree of decentralization, with no central authority controlling the exchange. UniSwap operates through a system of smart contracts, ensuring that transactions are transparent and secure.

UniSwap also offers low transaction fees and fast transaction times, making it an attractive option for users looking to trade cryptocurrencies. Its user-friendly interface and wide range of trading pairs make it one of the most popular DeFi DApps available.

ENS

ENS, or Ethereum Name Service, is a DeFi DApp that offers a human-readable naming system for Ethereum addresses, allowing users to send and receive cryptocurrency using easy-to-remember names instead of long, complicated addresses. ENS operates as a decentralized autonomous organization (DAO), with decisions made by community members who hold the ENS governance token.

One of the key benefits of ENS is its ability to simplify the process of sending and receiving cryptocurrency. Instead of remembering and entering long, complicated Ethereum addresses, users can simply use a human-readable name, such as "john.eth." This makes the process more user-friendly and less prone to errors.

ENS has made the list of top DeFi DApps in 2023 due to its potential to become a major player in the decentralized finance space. As more users adopt cryptocurrency and DeFi, the need for a user-friendly naming system will increase, making ENS an essential tool. Its user-friendly interface, security, and reliability make it popular for users looking to simplify their cryptocurrency transactions.

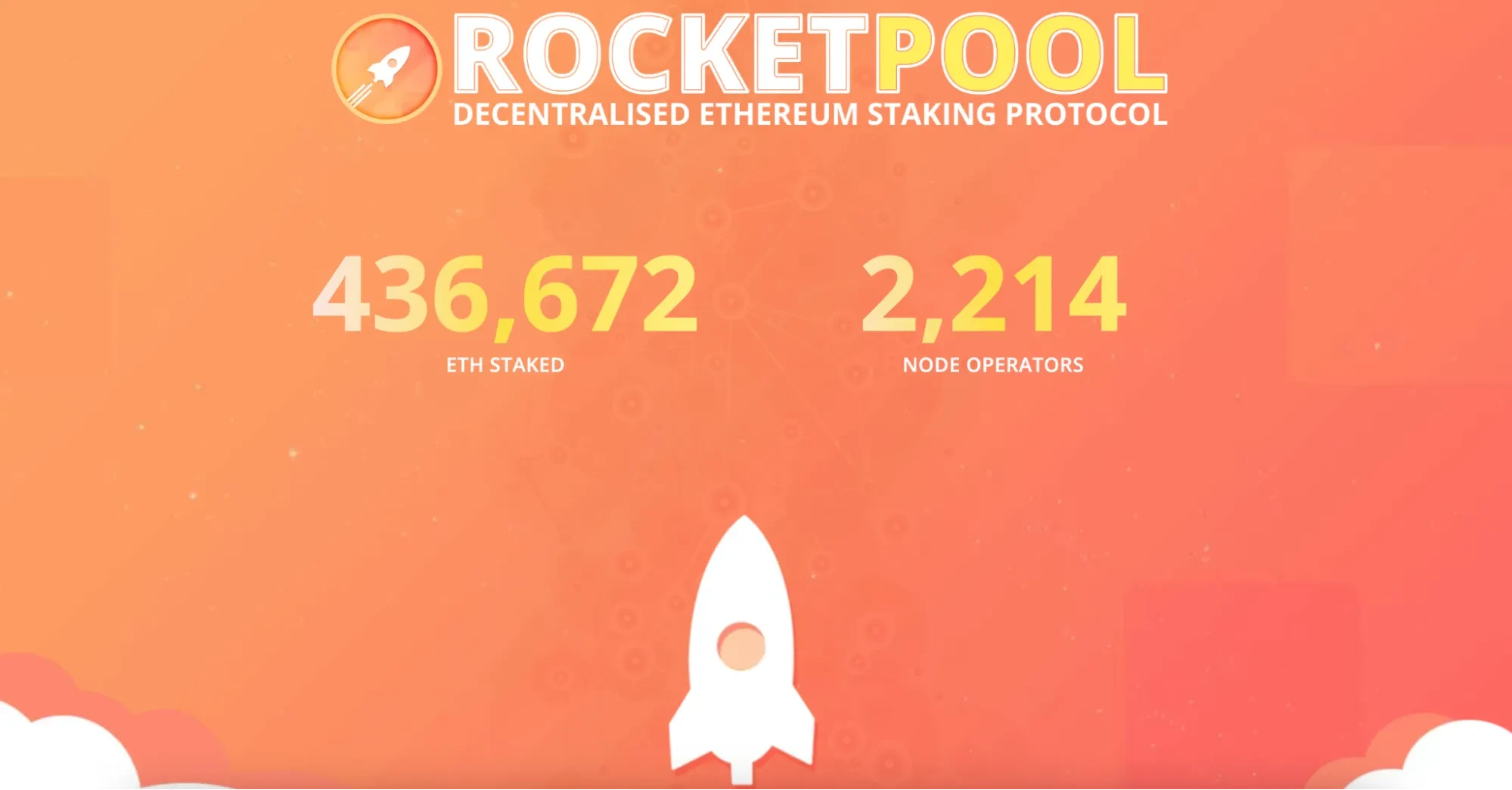

Rocket Pool

Rocket Pool is a DeFi DApp that provides a decentralized infrastructure for Ethereum 2.0 staking. It is built on the Ethereum blockchain and operates as a decentralized autonomous organization (DAO), with decisions made by community members who hold the RPL governance token.

One of the key benefits of Rocket Pool is its ability to provide a secure and decentralized way for users to stake their Ethereum and earn rewards without maintaining a minimum stake or technical knowledge. Rocket Pool allows users to deposit any amount of Ethereum and pool it with other users' funds, reducing the barrier to entry for staking.

Rocket Pool's unique features, such as its decentralization and accessibility, win it a spot on this list. Its user-friendly interface, security, and reliability make it an attractive option for users looking to stake their Ethereum and earn rewards in a decentralized and efficient manner. Additionally, Rocket Pool's ability to adapt to new developments in Ethereum 2.0, such as shard chains and cross-shard transactions, makes it a key player in the future of decentralized finance.

Lido

Lido is a DeFi DApp that allows users to stake their Ethereum and earn rewards through stETH, a DeFi token representing the user's share in the staking pool. Lido is a decentralized autonomous organization (DAO) that operates on the Ethereum blockchain.

Lido DAO provides users with a simple and efficient way to stake their Ethereum. Staking on the Ethereum network requires significant technical knowledge and capital, which can be a barrier for many users. Lido removes these barriers by providing a user-friendly interface and handling the technical aspects of staking on behalf of users.

Lido made it into this list as it offers high security, with users' Ethereum being held in a secure smart contract that multiple security firms audit. Additionally, stETH can be used for a variety of DeFi applications, such as trading and crypto lending, providing users with additional opportunities to earn rewards.

Magic Eden

Magic Eden is a DeFi DApp that offers a decentralized marketplace for trading non-fungible tokens (NFTs) and unique digital assets such as artwork, music, and collectibles. It is built on the Ethereum blockchain and operates as a decentralized autonomous organization (DAO), with decisions made by community members who hold the MGE governance token.

One of the key benefits of Magic Eden is its ability to provide a secure and transparent platform for trading NFTs. Magic Eden's platform allows users to buy and sell NFTs without the need for intermediaries, providing greater control and security over their transactions.

Magic Eden's unique features, such as its decentralized and user-friendly interface, have made it one of the top DeFi DApps in 2023. Its platform offers a wide range of NFTs for sale, providing users with a diverse marketplace to explore and discover new digital assets. Additionally, Magic Eden's focus on community governance ensures that decisions are made with users' interests in mind, making it a truly decentralized and transparent platform for NFT trading.

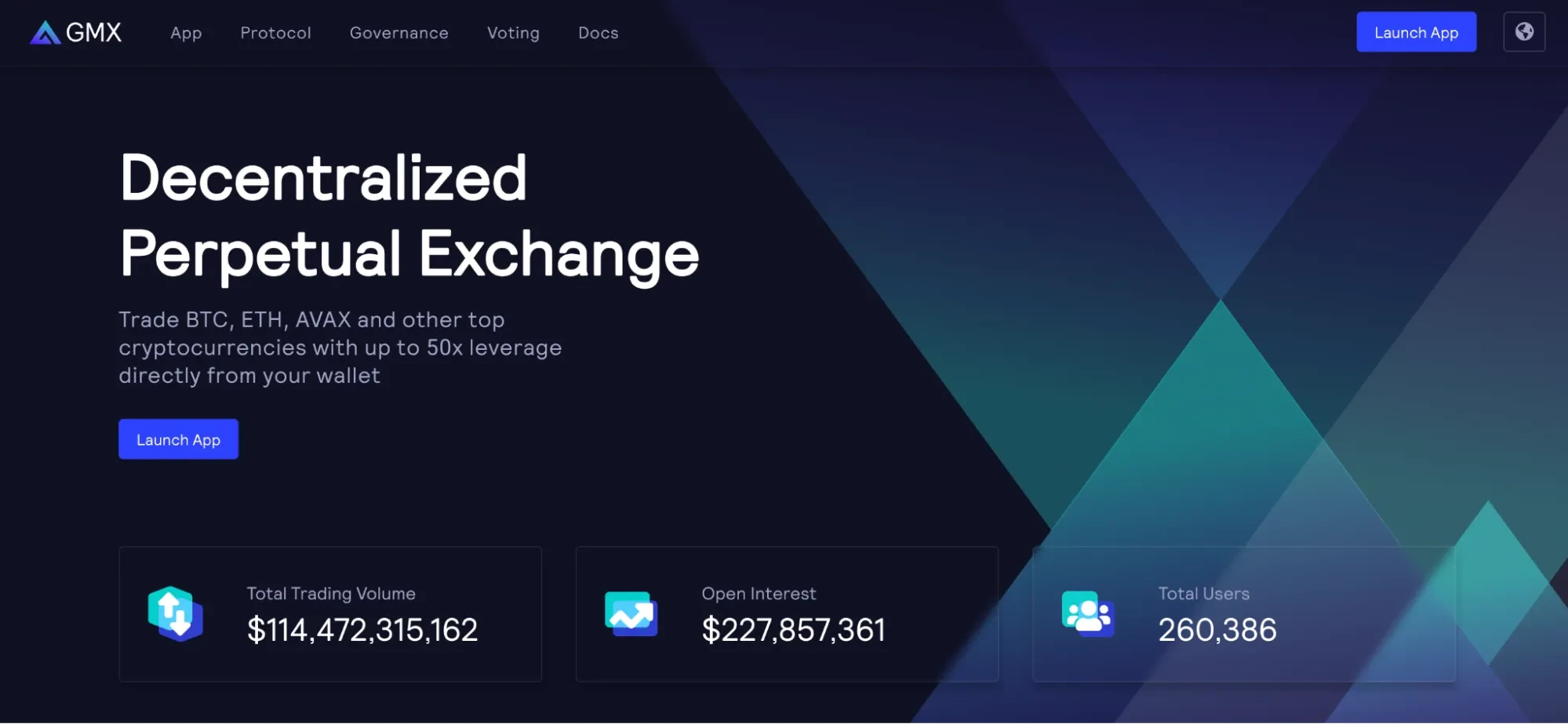

GMX

GMX is a DeFi DApp that provides a decentralized insurance platform for cryptocurrency users. It is built on the Ethereum blockchain and operates as a decentralized autonomous organization (DAO), with decisions made by community members who hold the GMX governance token.

One of the key benefits of GMX is its ability to provide a secure and decentralized way for cryptocurrency users to insure their holdings against price volatility and hacking attacks. In addition, GMX allows users to purchase insurance coverage for their cryptocurrency holdings, providing them with greater security and protection.

GMX's unique features, such as its decentralization and accessibility, earn it a spot on the best DeFi DApps in 2023. In addition, its platform offers users a wide range of insurance options, including coverage for price volatility and hacking attacks, making it an attractive option for cryptocurrency users looking to protect their investments.

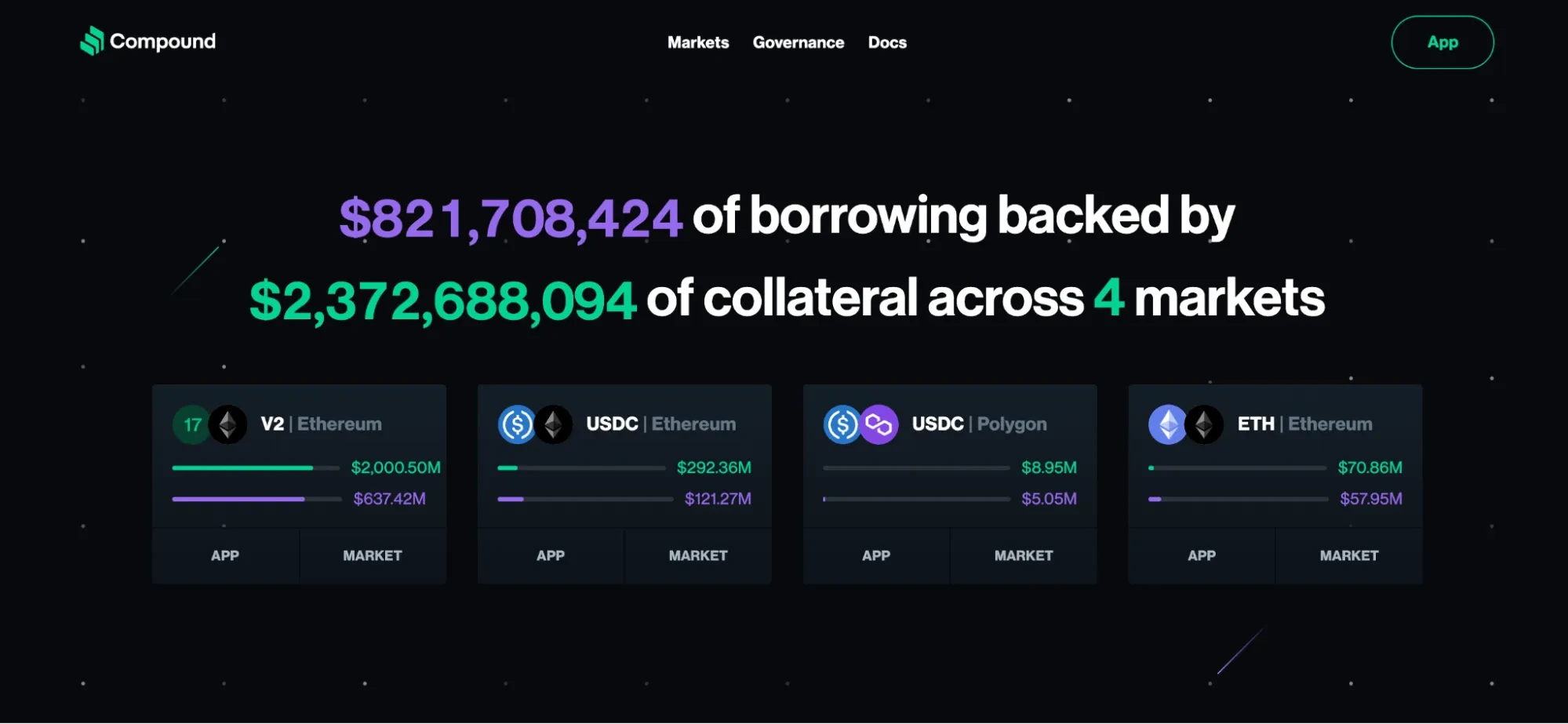

Compound

Compound is a DeFi DApp that provides a lending and borrowing platform for cryptocurrencies. It is built on the Ethereum blockchain and operates as a decentralized autonomous organization (DAO), with decisions made by community members who hold the COMP governance token.

One key benefit of Compound is the ability to provide a decentralized and transparent way for users to lend and borrow cryptocurrencies. Compound allows users to deposit their cryptocurrency holdings as collateral and borrow other cryptocurrencies. This is done with interest rates determined by the market supply and demand.

Compound's unique features, such as its decentralization and accessibility, have made it one of the top DeFi DApps in 2023. In addition, its platform offers users a wide range of lending and borrowing options, including stablecoins, making it attractive for users looking to earn interest on their cryptocurrency holdings or access additional funds.

The Future of DeFi Is Exciting

The DeFi ecosystem has grown significantly in recent years, and the top DeFi DApps in 2023 is expected to continue to offer innovative and reliable services to users. From stablecoins to decentralized exchanges, lending and borrowing platforms, oracle services, and staking pools, DeFi DApps provide users with a wide range of financial services in a decentralized and secure manner.

The top DeFi DApps in 2023 has been selected based on a set of criteria, including factors such as security, user experience, transaction fees, and overall adoption. These DApps offer unique features and benefits, allowing users to participate in the DeFi ecosystem in different ways.

As the DeFi ecosystem continues to grow, we expect to see new DeFi DApps emerge, providing users with even more opportunities to participate in the decentralized financial revolution. The future of DeFi is exciting, and we can look forward to seeing how these DApps evolve and shape the future of finance.

FAQs

What Are the Best DeFi Projects?

The best DeFi projects can vary depending on personal preference and individual needs. However, some popular and highly rated DeFi projects include UniSwap, Aave, Alchemix, and Compound. Due to their unique features, benefits, and reliability, these projects have gained significant attention and adoption in the DeFi ecosystem.

What Is the Biggest DeFi Application?

As the DeFi ecosystem constantly evolves, it's difficult to determine the biggest DeFi application. However, according to current trends and data, UniSwap might be considered one of the biggest DeFi applications as of 2023, with a significant daily trading volume and a high degree of decentralization. However, it's important to note that other DeFi applications may emerge and gain popularity in the future, making it difficult to predict the biggest DeFi application with certainty.

What Is the Best Platform for DeFi?

The best platform for DeFi depends on individual needs and preferences. However, some of the most widely used and popular platforms for DeFi include Ethereum, Binance Smart Chain, and Avalanche. Ethereum is the most established platform for DeFi, offering a high degree of decentralization and security. Binance Smart Chain has fast transaction times and low fees, making it an attractive option for users. Avalanche offers high throughput and low-latency transactions, providing a fast and efficient platform for DeFi activities. Ultimately, the best platform for DeFi depends on personal preference, specific DeFi applications, and desired features.

Which Crypto Is Best for DeFi?

The best cryptocurrency for DeFi depends on the specific DeFi application and individual preferences. Some of the most popular cryptocurrencies used in DeFi include Ethereum, Bitcoin, and stablecoins like USDC. Ethereum is the most widely used cryptocurrency in DeFi, serving as the foundation for many DeFi projects and allowing for the creation of smart contracts. Ultimately, the best cryptocurrency depends on the specific DeFi application and individual preferences.

© 2023 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state:"This article is © 2023 OKX and is used with permission." Permitted excerpts must cite to the name of the article and include attribution, for example "Article Name, [author name if applicable], © 2023 OKX." No derivative works or other uses of this article are permitted.