What is a Directed Acyclic Graph (DAG)?

Ever since the blockchain was created, it became apparent that this technology is far better than that used in traditional banking. Although it took a long time, financial institutions finally started paying attention to it. However, blockchain technology isn’t the only piece of evolutionary technology to emerge from the fintech space.

Many within the financial world deem Directed Acyclic Graph (DAG) as another piece of revolutionary technology. While many associate this with the blockchain, DAG technology is its own, separate solution. Some even consider it as an alternative to the blockchain. This guide will explain what it is, how it works and how it compares to blockchain technology.

DAG vs Blockchain technology

A Directed Acyclic Graph, or DAG, is a data modeling or structuring tool that some cryptocurrencies use instead of a blockchain. DAG is commonly referred to as a “blockchain killer”, as some believe this type of technology could overthrow the blockchain. Whether or not this will actually happen remains to be seen. Blockchain technology is currently the main tech used in the cryptocurrency industry.

DAG Architecture

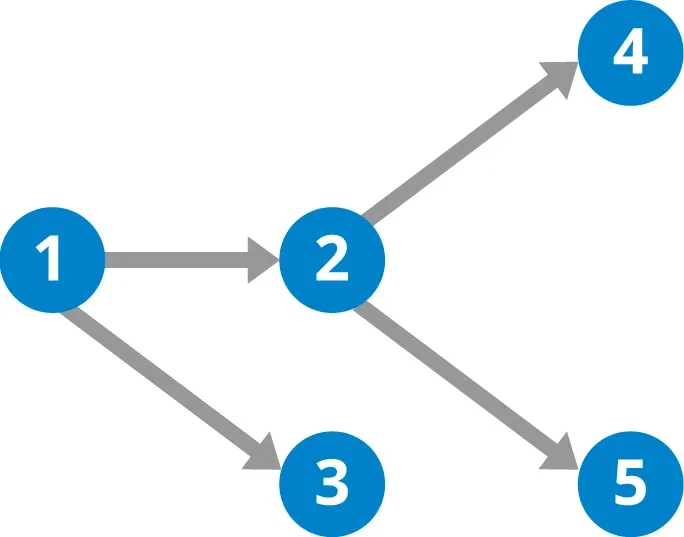

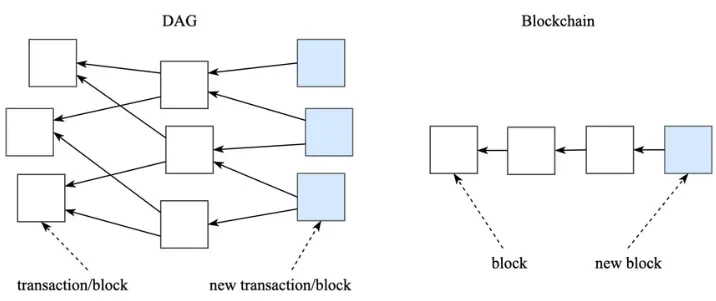

The DAG architecture relies on circles and lines. Each circle (vertex) represents activities that need to be added to the network. Meanwhile, every line (edge) represents the order in which transactions are approved. The lines also only head in one direction. This is where the name Directed Acyclic Graph comes from. DAGs are Directed, as they only head in one direction. They are also acyclic, as the vertices don’t loop back on themselves.

This data structure is generally used for data modeling as DAGs allow users to observe relationships between multiple variables. Researchers can also determine how the variables impact each other. Of course, in crypto, they can help projects achieve consensus in a distributed cryptocurrency network.

It’s also worth noting, transactions aren’t gathered into blocks but built on top of one another. This significantly improves transaction speed in comparison to the blockchain.

What is the difference between a DAG and a blockchain?

DAGs and blockchain mostly play the same role in the crypto industry. However, there are differences between the two technologies. For example, DAGs do not create blocks, as blockchains do. They simply build transactions on top of previous ones, as mentioned above.

DAGs are also made up of circles and lines, opposed to blocks. This is why blockchains look like a chain of blocks, while DAGs look like graphs.

How does DAG technology work?

In order to explain how DAG technology works, all we need to do is summarize the points explained above. As mentioned above, DAG-based systems are composed of circles and lines. Each Circle (or vertex) represents a transaction, and transactions are built on top of one another.

If a user wants to make a transaction, it needs to confirm a transaction that was submitted prior to theirs. Transactions performed before your own are called “tips.” Tips are unconfirmed transactions, but in order to submit your own, you must first confirm the tips.

Then your transaction will become the new tip. It will have to wait for someone else to confirm it, in order for them to perform their own transaction. This way, the community builds layer after layer after layer of transactions, and the system continues to grow.

The DAG technology also has a system that prevents double-spending. When nodes confirm older transactions, they assess the entire path back to the first transaction. In doing so, they can confirm that the balance is sufficient and everything is in order.

Users who build on an invalid path risk having their own transactions ignored. Even if theirs is legitimate, it could still be ignored if the balance doesn’t check out because of previous transactions. This will only be the case if the past transactions were not legitimate.

What is DAG used for?

DAGs are primarily used for processing transactions more efficiently than blockchain. Since there are no blocks, there are no waiting times tied to the transaction. This allows users to submit as many transactions as they want. Of course, they must confirm old ones before moving on to the new ones.

DAGs are also energy-efficient since they do not rely on traditional mining. Blockchains that use the PoW consensus algorithm require a lot of power. Meanwhile, cryptos that use DAGs still require the PoW consensus algorithm, but only consume a fraction of energy.

DAGs can also be very useful for processing micropayments. Being a distributed ledger, blockchains can struggle with micropayments, and transaction fees often end up being much larger than the payment itself. With DAGs, no processing fees are needed, only a small node fee. Even if there is network congestion, this fee does not increase.

Which cryptocurrencies use DAG?

While many believe that DAGs are more efficient than blockchain, only a handful of projects are still using them. One example is IOTA — a project whose name is an acronym for Internet Of Things Application.

Launched in 2016, IOTA (MIOTA) became known for fast transaction speed, scalability, security, privacy, and great data integrity. It uses nodes and tangles, which are combinations of multiple nodes that are used to validate transactions. In order to have their transaction approved, users need to verify two other transactions.

All users are therefore involved with the consensus algorithm. That way, the network is completely decentralized.

Another project that uses DAGs instead of blockchain is Nano.

Nano is not a pure-DAG project, instead, it combines DAG and blockchain technology. All data is sent and received through nodes, and each user has their own wallet, which is where the blockchain comes in. When performing transactions, both the sender and receiver have to verify the payment. Nano is also known for fast transaction speed, scalability, security, privacy and zero transaction fees.

DAG pros and cons

Like the blockchain, DAG also has its own advantages and disadvantages. For example:

DAG Pros

Speed: DAGs are not restricted by block time, so anyone can have their transaction processed at any time. There is no limit on a number of transactions, just the obligation to confirm previous ones.

Zero fees: Since there’s no mining, there are also no fees meant to act as rewards for miners. With that being said, some DAGs require a small fee for special kinds of nodes. Low or zero fees are particularly helpful for microtransactions.

No mining: DAGs do not use PoW consensus algorithms in the same way as blockchain. As a result, they spend less power, and their carbon footprint is minimal.

Ability to scale: With no block times, there are no long waiting periods, so DAGs do not suffer from scalability issues.

DAG Cons

Decentralization issues: Some protocols that use DAGs have certain elements of centralization. Many have accepted this as a short-term solution to bootstrap the network. However, DAGs have yet to reach the times when they will be able to thrive with no third-party interventions. Without these interventions, they could be open to attacks.

Not tested at scale: Another negative is that DAG-based cryptos have not yet seen widespread use. Without data to back up their supposed capabilities, it is difficult to know for sure how they would behave.

Can DAGs replace the blockchain?

Directed Acyclic Graphs are an interesting and potentially revolutionary piece of technology. While they offer advantages such as lower fees and greater scalability than blockchain, they are still underdeveloped. DAGs still have flaws that prevent them from truly challenging blockchain technology.

The technology is still considered to be in its youth and its limitations and possibilities are yet unexplored. Their advantages certainly do look promising, and they keep researchers and developers interested. However, whether or not DAG technology will replace blockchain in the future is yet to be seen.

FAQs

What is a directed acyclic graph known as a DAG?

DAG is a type of data-processing network primarily used for cryptocurrencies. It performs similar tasks as blockchain technology, although in a vastly different way.

What is a directed acyclic graph with an example?

One example of DAG is IOTA, where anyone can perform as many transactions as they want. In order to have their transaction approved, they must verify two other transactions. These other transactions were made by other users, and once verified, they allow the original user to build on them.

What is DAG used for?

DAG is used for processing transactions in the crypto industry. It allows crypto users to make payments and verify payments for each other. In return, their transaction gets processed.

Are DAGs better than blockchain?

DAGs have certain elements that make them better than blockchain in some aspects. They are faster, cheaper, and more scalable. However, they are also untested at scale, and impossible to run without some amount of centralization.

Does cardano use DAG?

No, Cardano does not use DAG. It runs its own blockchain, which is used for payments, launching smart contracts, decentralized applications, and more.

Which cryptos use DAG?

Some best-known cryptocurrencies that use DAG are IOTA, Obyte, and Nano. In the future, more projects might try out this technology. For now, however, most projects are relying on blockchain, instead.